The global supply chain crisis under the epidemic has brought a large number of return orders to the Chinese textile industry.

Data from the General Administration of Customs shows that in 2021, the national textile and apparel exports will be 315.47 billion US dollars (this caliber does not include mattresses, sleeping bags and other bedding), a year-on-year increase of 8.4%, a record high.

Among them, China’s clothing exports increased by nearly 33 billion US dollars (about 209.9 billion yuan) to 170.26 billion US dollars, a year-on-year increase of 24%, the largest increase in the past decade. Before that, China’s apparel exports had been declining year by year as the textile industry shifted to lower-cost Southeast Asia and other regions.

But in fact, China is still the world’s largest textile producer and exporter. During the epidemic, China, as the center of the world’s textile and apparel industry chain, has strong resilience and comprehensive advantages, and has played the role of “Ding Hai Shen Zhen”.

The data of clothing export value in the past ten years shows that the growth rate curve in 2021 is particularly prominent, showing a steep contrarian growth.

In 2021, foreign clothing orders will return to more than 200 billion yuan. According to the data of the National Bureau of Statistics, from January to November 2021, the output of the clothing industry will be 21.3 billion pieces, an increase of 8.5% year-on-year, which means that foreign clothing orders have increased by about one year. 1.7 billion pieces.

Due to the advantages of the system, during the epidemic, China controlled the new crown pneumonia epidemic earlier and better, and the industrial chain basically recovered. In contrast, the repeated epidemics in Southeast Asia and other places affected production, which made buyers in Europe, America, Japan and Southeast Asia place orders directly. Or indirectly transferred to Chinese enterprises, bringing the return of clothing production capacity.

In terms of exporting countries, in 2021, China’s apparel exports to the three major export markets of the United States, the European Union and Japan will increase by 36.7%, 21.9% and 6.3% respectively, and exports to South Korea and Australia will increase by 22.9% and 29.5% respectively.

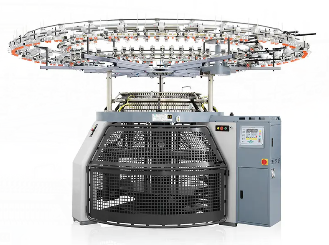

After years of development, China’s textile and garment industry has obvious competitive advantages. It not only has a complete industrial chain, a high level of processing facilities, but also has many developed industrial clusters.

CCTV has previously reported that many textile and garment enterprises in India, Pakistan and other countries cannot guarantee normal delivery due to the impact of the epidemic. In order to ensure continuous supply, European and American retailers have transferred a large number of orders to China for production.

However, with the resumption of work and production in Southeast Asia and other countries, orders that were previously returned to China have begun to be transferred back to Southeast Asia. Data show that in December 2021, Vietnam’s clothing exports to the world increased by 50% year-on-year, and exports to the United States increased by 66.6%.

According to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), in December 2021, the country’s garment shipments increased by about 52% year-on-year to $3.8 billion. Despite the shutdown of factories due to the epidemic, strikes and other reasons, Bangladesh’s total clothing exports in 2021 will still increase by 30%.

Post time: Feb-22-2022